30+ Online payroll calculator 2021

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. So Many Payroll Programs So Little Time.

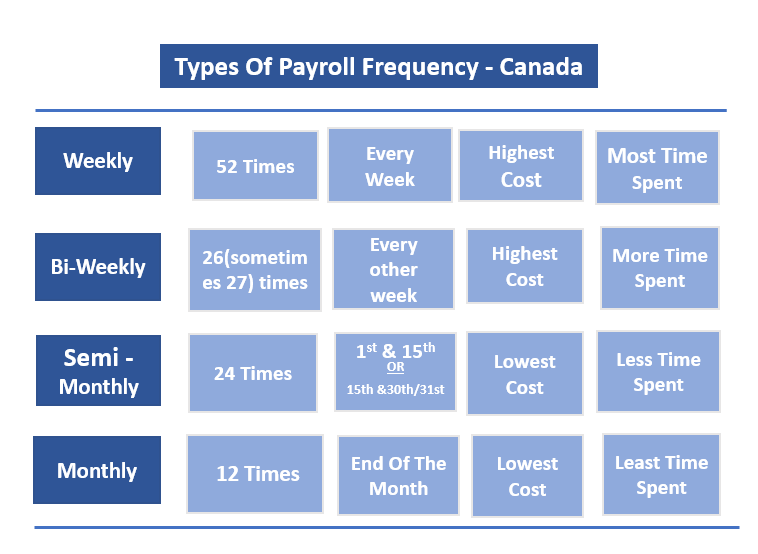

Everything You Need To Know About Running Payroll In Canada

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding.

. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Free 2021 Payroll Deductions Calculator. Calculate paychecks and prepare payroll any time.

Ad Process Payroll Faster Easier With ADP Payroll. Efficiently manage end-to-end third party payroll processing without leaving Oracle HCM. Ad Find The Right Program To Manage And Support Your Employees From Hire To Retire.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Get Started With ADP Payroll. Ad Compare This Years Top 5 Free Payroll Software.

Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions. It will confirm the deductions you include on your. Federal Salary Paycheck Calculator.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Discover ADP Payroll Benefits Insurance Time Talent HR More. Small Business Low-Priced Payroll Service.

Ad Payroll Doesnt Have to Be a Hassle Anymore. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Ad Process Payroll Faster Easier With ADP Payroll.

Ad Manage your diverse payroll requirements with Oracle Global Payroll. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Ad Streamline your payroll benefits onboarding and integrations all in one place.

You can enter your current payroll information and. 3 Months Free Trial. Heres a step-by-step guide to walk you through.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Computes federal and state tax withholding for. Form TD1-IN Determination of Exemption of an Indians Employment Income.

The standard FUTA tax rate is 6 so your max. We hope these calculators are useful to you. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

Free Unbiased Reviews Top Picks. With the online paycheck calculator software you can. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Next divide this number from the. If payroll is too time consuming for you to handle were here to help you out. If you need a little extra help running payroll our calculators are here to help.

We Can Help You Make The Right Decision. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Paycheck Manager is designed to make these tasks simple.

Rules for calculating payroll taxes. Double check your calculations for hourly employees or make sure your salaried. For example if an employee earns 1500.

This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after deductions and federal state and local income tax withholding. Income Tax formula for old tax regime Basic Allowances Deductions 12 IT Declarations Standard deduction Deductions. Start Afresh in 2022.

Taxes Paid Filed - 100 Guarantee. Starting as Low as 6Month. No Need to Transfer Your Old Payroll Data into the New Year.

Use this calculator to help you determine the impact of changing your payroll deductions. Free salary hourly and more paycheck calculators. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

Find Easy-to-Use Online Payroll Companies Now. When you choose SurePayroll to handle your small business payroll. How to calculate annual income.

Updated September 30 2021. Gustos modern people platform helps you pay manage and support your team. Enter your info to see your take home pay.

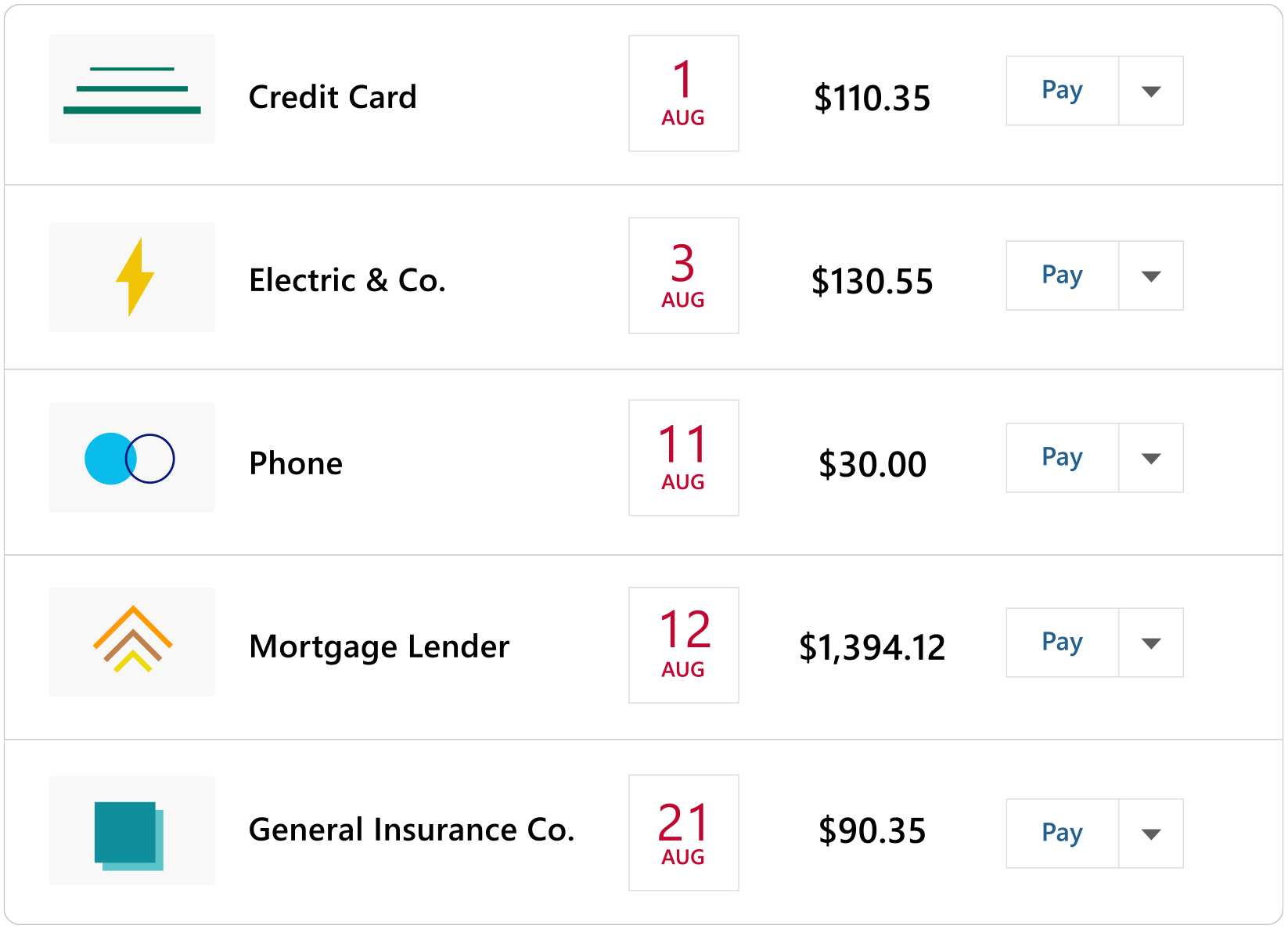

Be reminded of pending. How do I calculate hourly rate. Get Started With ADP Payroll.

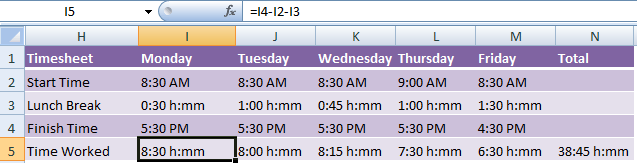

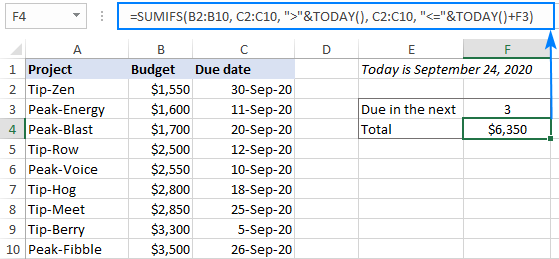

Calculating Time In Excel My Online Training Hub

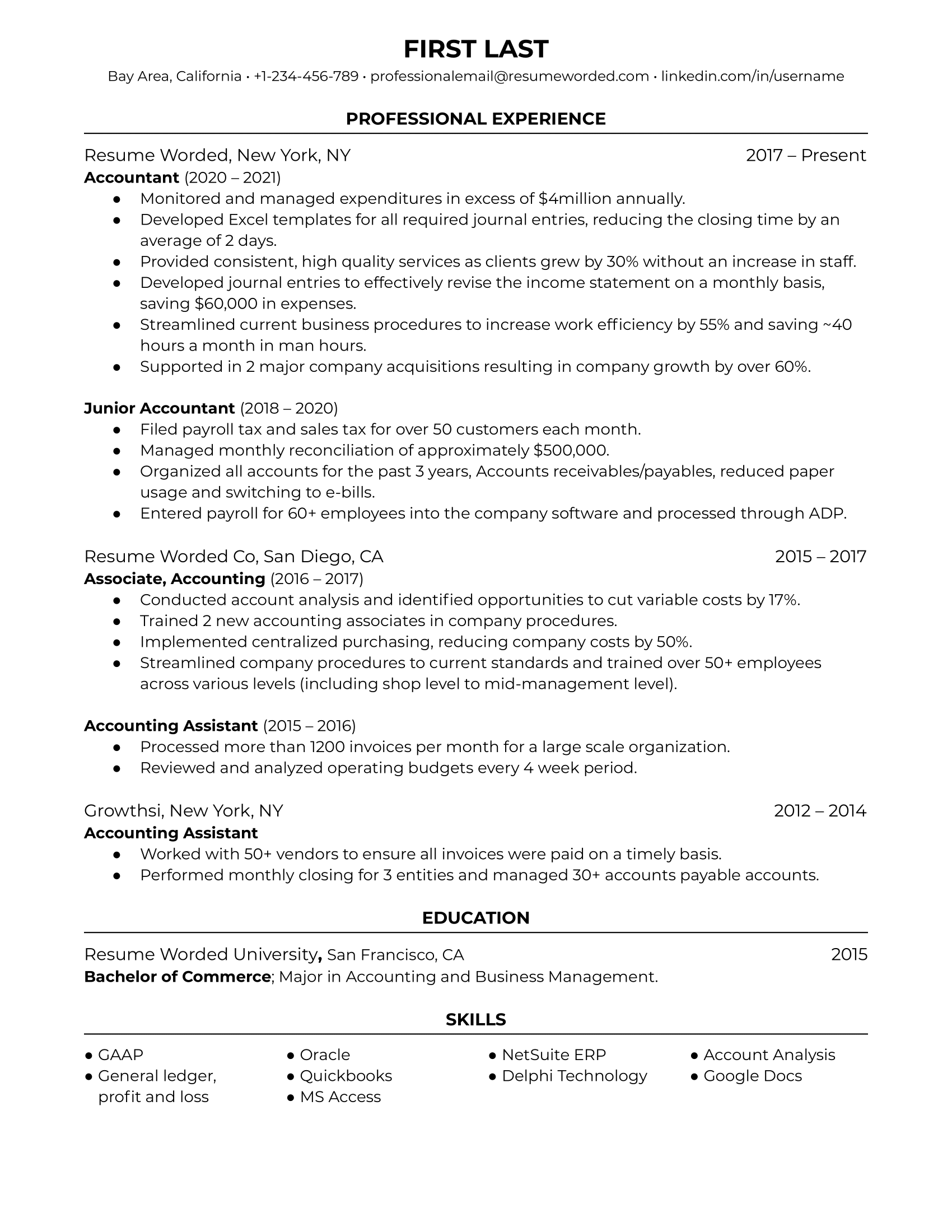

11 Accountant Resume Examples For 2022 Resume Worded

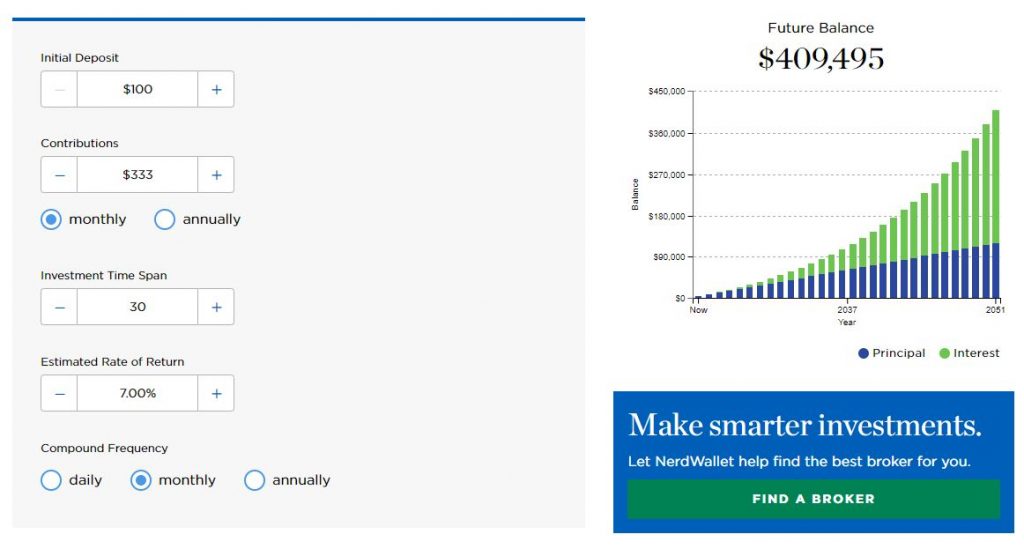

80 000 A Year Is How Much An Hour Saving Budgeting Guidelines

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Payroll Checks

Cute Monthly Budget Printable Free Editable Template Free Budget Printables Household Budget Template Monthly Budget Template

80 000 A Year Is How Much An Hour Saving Budgeting Guidelines

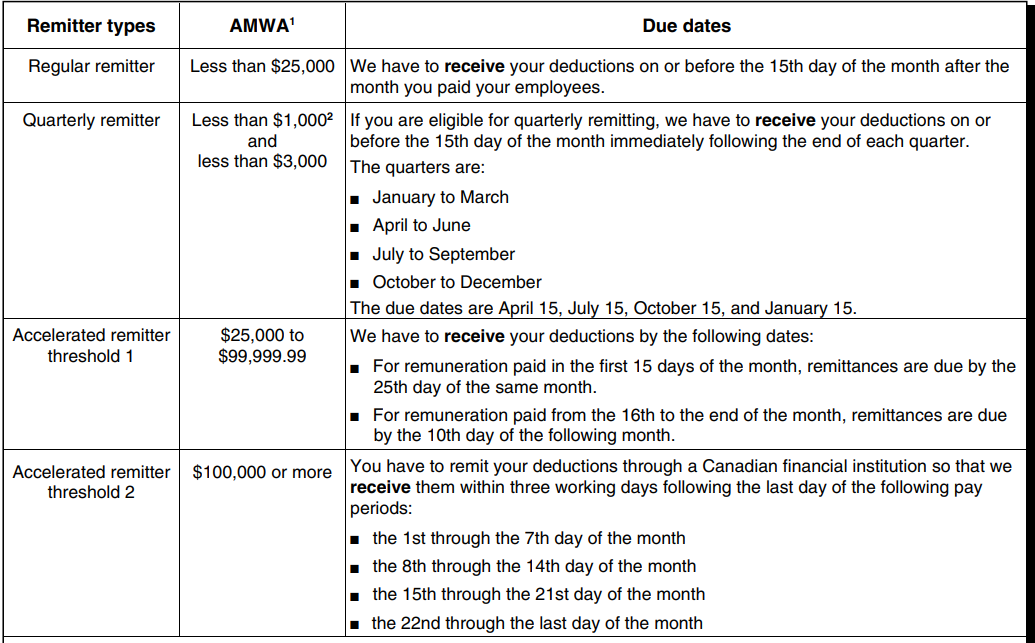

Everything You Need To Know About Running Payroll In Canada

Quicken Home Business Quicken

Hourly Wage Then Log Download Pay Stub Template Word Free With Regard To Pay Stub Template Word Document Cumed O Word Free Templates Microsoft Word Templates

80 000 A Year Is How Much An Hour Saving Budgeting Guidelines

Payroll And Ownership Worksheet Payroll Template Payroll Business Template

Everything You Need To Know About Running Payroll In Canada

Tops Weekly Time Sheets 5 1 2 X 8 1 2 50 Pad 2 Pack 30071 Officecrave Com Sheet Excel Budget Template Pad

How Do I Get Past This Error To Proceed Setting Up Qbo The Amounts Entered May Be Incorrect Ss Amp Medicare Taxes Fica Are Expected To Be Percentages

Cryptosister Crypto Sister Twitter

Excel Sumifs Date Range Formula Sum If Between Two Dates

Daily Vehicle Inspection Checklist Excel Checklist Template Inspection Checklist Business Template